by Chris Banescu –

by Chris Banescu –

The latest economic data released Thursday confirms what all Americans, especially business owners, already knew. Economic growth has slowed down to a measly 1.5% (from 2% the previous quarter), job growth continues to languish with nationwide unemployment at a dismal 8.2%, consumer confidence has fallen to its lowest level this year, and consumer spending is also tanking. Household purchases, which represent approximately 70% of GDP, grew at the slowest pace in a year. Recent surveys show that Americans have lost approximately 40% of their net worth in the last few years, and poverty rates are reaching levels not seen in this country since the 1960s.

So, why are the markets up?

Everything confirms that our bleak economic situation just got worse. Obama’s anti-business, anti-job growth, and punitive taxation schemes have not changed. The administration’s stifling and oppressive regulatory policies continue unabated. The European situation has not improved or stabilized much, despite repeated assurances from the European Central Bank. The Federal Reserve in the United States is already out of options, despite speculation from the so-called financial “experts” who believe that another round of “stimulus” may occur, even though the Fed signaled just the opposite last week. Given the poor record of previous easing and the near-zero interest rates, there is very little the Fed can do now.

So what could possibly have influenced the financial markets to push the Dow Jones, S&P 500, and Nasdaq averages into solid positive gains for the day?

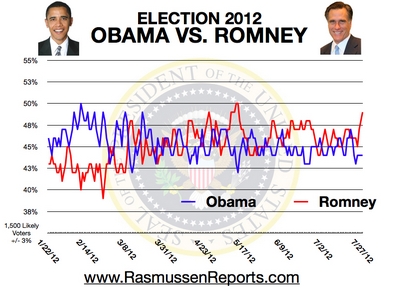

Interestingly enough, the Rasmussen Reports released yesterday their latest Presidential Tracking Poll. It shows that for the first time in this election cycle, presidential candidate Mitt Romney has pulled ahead. He now has a 5-point lead over President Obama. Mr. Romney now polls at 49% of voter support versus 44% for Obama.

The same poll reveals that 49% of Americans trust Romney to better handle the economy, while only 43% place that kind of trust in President Obama. Nearly a majority of Americans are finally beginning to understand that only a pro-business, pro-free markets, pro-capitalism, and pro-low taxes president will get America out of the dreadful financial and economic straits we’re in and put the country back on the right course.

Could this be the real reason why the markets responded with such enthusiasm? I suspect that that might have something to do with it.

UPDATE – Monday 7/30/2012:

Apparently I’m not the only one to notice the correlation between Mitt Romney’s improving chances of winning the November elections and the increased optimism of U.S. financial markets. CNBC is reporting similar analysis from other sources:

One analysis concludes that last week’s sharp three-day market surge can only mean that Wall Street is banking on a victory from Republican Mitt Romney.

That’s the logical interpretation one can draw from a rally amid conditions that otherwise would demand a selloff, Morgan Stanley chief U.S. equity strategist Adam S. Parker said in an analysis that asserts there is no other reason now to like stocks than a Romney win.

You could be right…