by Paul Bedard

by Paul Bedard

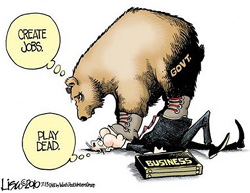

The International Franchise Association held a convention in Washington this week where most of the Radio Shack, Dunkin Donuts, Curves and other franchisers were grumbling about new federal regulations, especially the impact of Obamacare.

Most, said Atlanta Taco Bell and Kentucky Fried Chicken franchiser David Barr, presumed that the reports about how hard Obamacare will hit them were overblown. “They had their head in the sand,” he told Secrets.

That is until he pulled out his powerpoint showing how funding Obamacare will cut his –and likely their– profits in half overnight. [Read more…]

by Chris Banescu –

by Chris Banescu – If you knew a dollar invested in something would wind up losing more than a dollar, would you consider that a good investment?

If you knew a dollar invested in something would wind up losing more than a dollar, would you consider that a good investment? by James E. Miller –

by James E. Miller – by Tom McClintock –

by Tom McClintock – by Ryan Ellis –

by Ryan Ellis –